Accumulated depreciation formula straight line

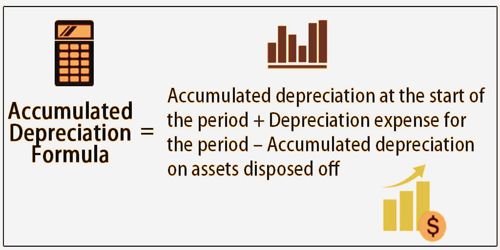

There are three key ways to calculate the accumulated depreciation of an asset. Annual Depreciation Purchase Price Salvage Value Years in Useful Life.

Accumulated Depreciation Definition Formula Calculation

500000 100000 10.

. 2 x Straight-line depreciation rate x Remaining book value A few notes. The straight-line depreciation method considers assets used and provides the benefit equally to an entity over its useful life so that the depreciation charge is equally. The double declining balance depreciation method is an accelerated depreciation method that counts as an expense more rapidly when compared to straight-line depreciation that uses the.

Depreciation expense 50000. Depreciation Expense 2 x Basic Depreciation Rate x Book Value. Understanding asset depreciation is an important part of.

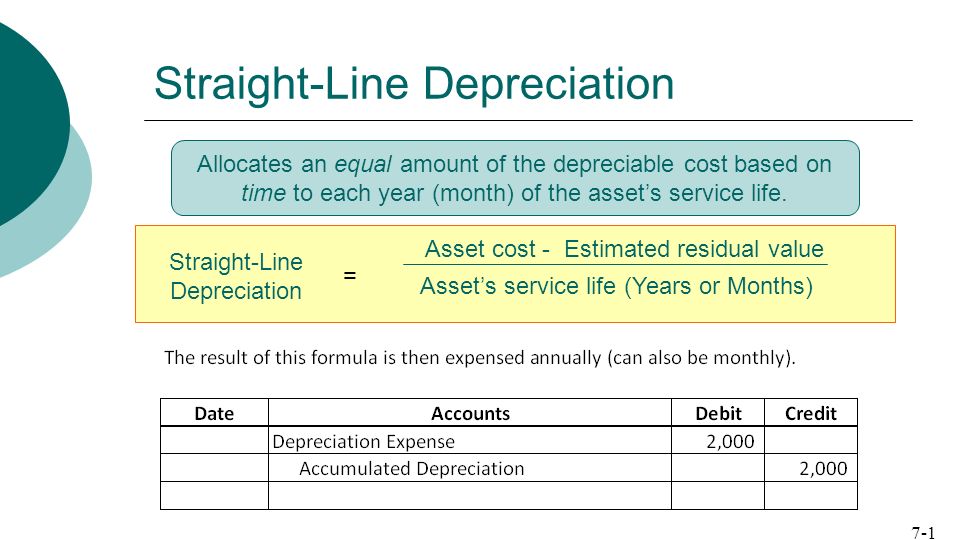

The formula for the straight-line depreciation method is quite straightforward to calculate. Book value residual value X depreciation rate. The methods used to calculate depreciation include straight line declining balance sum-of-the-years digits and units of production.

An assets carrying value on the balance sheet is the difference between. Depreciation rate for double declining balance method 20 200 20 2 40 per year. The depreciation rate is the rate that fixed assets.

Find the straight-line depreciation rate. Where Book value of fixed assets is the original cost of fixed assets including another necessary cost before depreciation. The scrape value is around 10000.

Please prepare the straight-line depreciation journal entry. Sum-of-years-digits is a spent depreciation method that results in a more accelerated write-off than the straight-line method and typically also more accelerated than the declining balance method. First if the 150 declining balance method is used the factor of two is replaced by 15.

With the straight-line method you use the following formula. Cost of Assets. Cost of Asset is.

The straight-line method the declining balance method and the double-declining balance. Under this method the annual depreciation is determined by multiplying the depreciable cost by a schedule of fractions. The DDB rate of depreciation is twice the straight-line method.

Annual Depreciation Depreciation Factor x 1Lifespan x Remaining Book Value. Adapt this to a. Straight line depreciation cost of the asset estimated salvage value estimated useful life of an asset.

First we need to calculate the monthly depreciation expense. In year one you multiply the cost or beginning book value by 50. Straight-line depreciation is a simple method for calculating how much a particular fixed asset depreciates over time.

2x Straight - Line depreciation rate x Remaining book value When the 150 declining balance method is used the factor of two is removed and 15 is used instead. Hence the straight line depreciation rate 15 20 per year. The formula for calculating straight line depreciation is.

Here are the steps you can use to calculate accumulated depreciation using the double-declining balance method. Depreciation Expense Cost of Asset Scrap value Useful life time. Now the depreciation formula for the straight-line method will be.

You then find the year-one. Here is the formula for calculating accumulated depreciation using the double-declining balance method. Simple formula for accumulated depreciation.

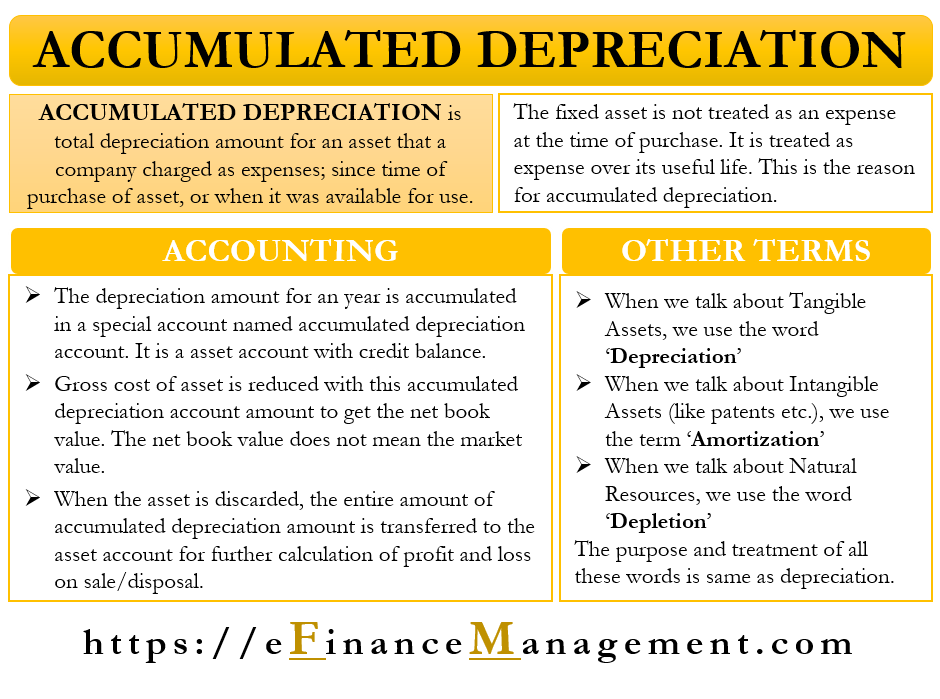

Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life.

Accumulated Depreciation Meaning Accounting And More

Straight Line Depreciation Accountingcoach

Accumulated Depreciation Definition Formula Calculation

Depreciation Formula Examples With Excel Template

Straight Line Depreciation Allocates An Equal Amount Of The Depreciable Cost Based On Time To Each Year Month Of The Asset S Service Life Asset Cost Ppt Download

Accumulated Depreciation Assignment Point

Depreciation Formula Examples With Excel Template

Straight Line Depreciation Accountingcoach

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Expense Double Entry Bookkeeping

Declining Balance Depreciation Calculator

What Is Accumulated Depreciation How It Works And Why You Need It

Depreciation Methods Principlesofaccounting Com

Straight Line Depreciation Double Entry Bookkeeping

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Explained Bench Accounting

Accumulated Depreciation Definition Formula Calculation